Mechanic’s Liens: How stop notices and bond claims interact

The interaction between stop notices and bond claims, particularly when considering Mechanic’s Liens (MLs), revolves around providing security and recourse for subcontractors, laborers, and material suppliers who have not received payment for work performed, especially on construction projects where traditional Mechanic’s Liens are unavailable.

Here is an overview of how these mechanisms operate and interact:

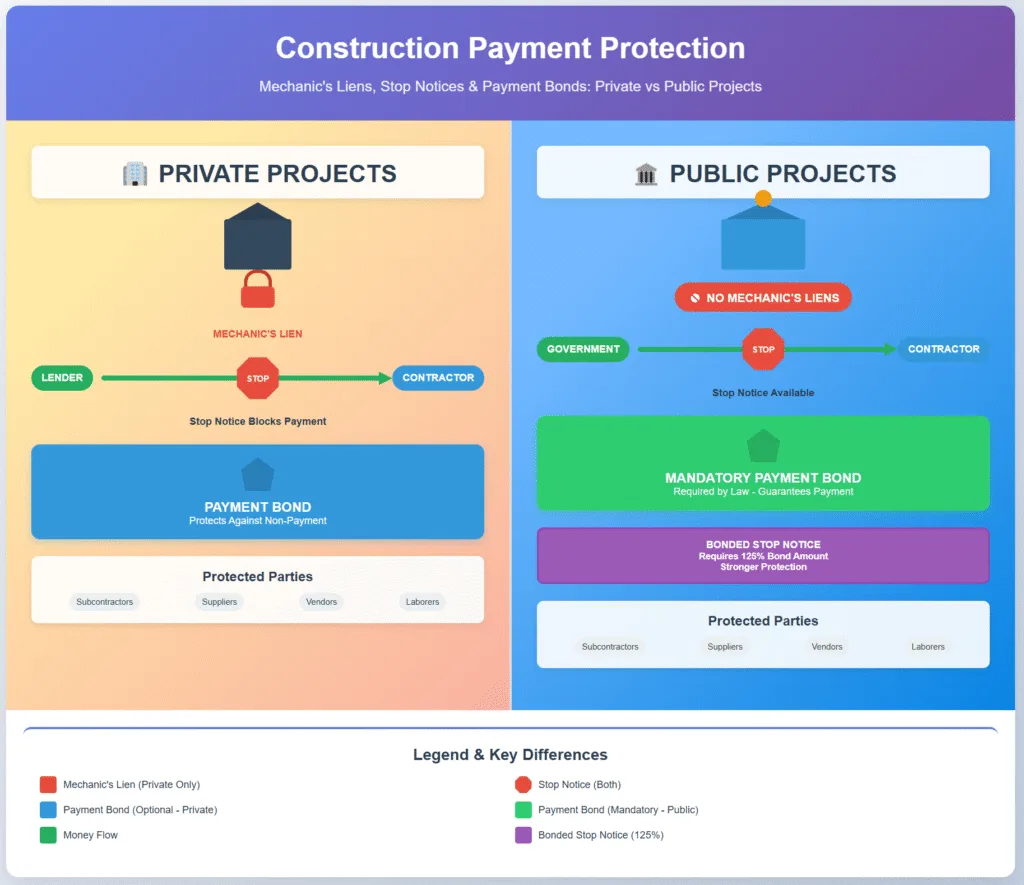

1. Stop Notices

A stop notice is a legal tool used by a claimant (e.g., subcontractor, vendor, material supplier) to secure payment by claiming a lien against construction funds.

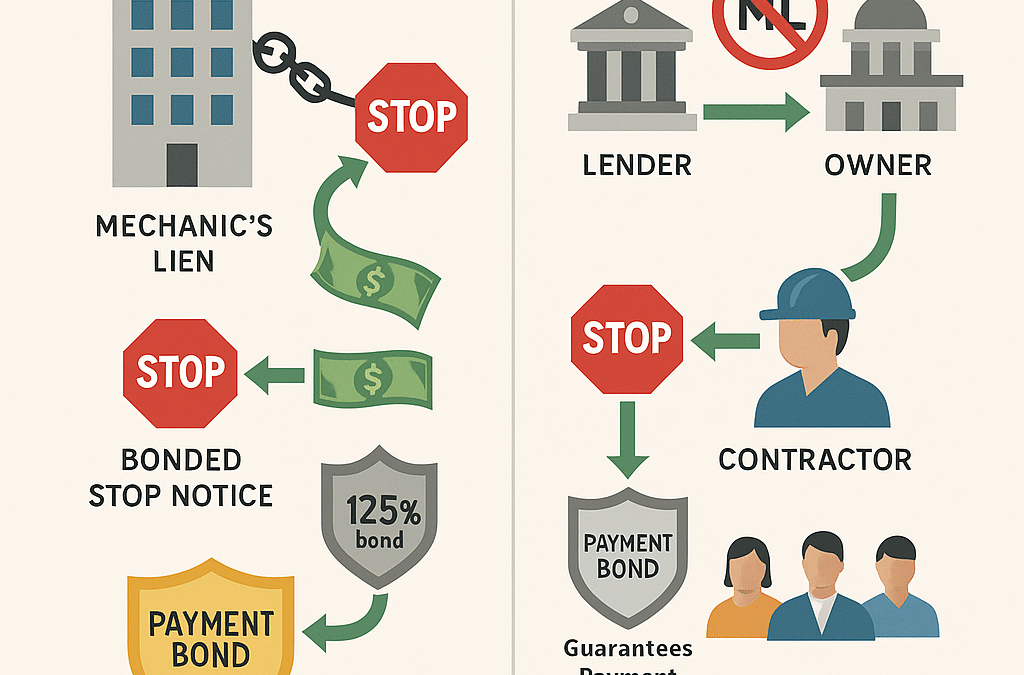

- Lien Against Funds: Unlike a Mechanic’s Lien, which is a claim against the real property itself, a stop notice is a lien against the funds designated for the construction work.

- Applicability: Stop notices can be utilized on both private projects and public projects.

- Effect: A stop notice requires the party holding the construction funds (e.g., a lender on a private job, or the public owner/agency on a public job) to withhold sufficient funds to satisfy the amount owed to the claimant, effectively stopping the flow of money to the job.

- Bonded Stop Notice: If a stop notice is accompanied by a bond (in the amount of 125% of the claim), it is called a bonded stop notice, and the lender generally does not have the option to withhold the funds; they must do so.

2. Bonds (Payment Bonds)

In construction contracts, particularly on larger projects, the owner may require the contractor to provide surety bonds as a form of assurance. These bonds typically protect the owner from the financial risk associated with contractor failure or claims by unpaid lower-tier parties.

- Payment Bonds: A Payment Bond specifically secures the payment of claims made by laborers, subcontractors, vendors, and material suppliers.

- Owner Protection: Payment Bonds serve to protect the owner from having liens filed on their property, as the bond guarantees that subcontractors and material suppliers will be paid.

- Public Projects Requirement: The California Public Contract Code requires competitive bidders on public projects to obtain performance bonds (guaranteeing faithful performance) and payment bonds (securing payment claims).

3. Interaction: Public Projects (Where MLs are Prohibited)

The interaction between stop notices and payment bonds is most critical on public projects because government property cannot be subject to a Mechanic’s Lien.

- ML Replacement: Since a claimant cannot file an ML against public property, the stop notice is the only lien available for public projects, serving as recourse against the public funds held by the owner of the public work.

- Dual Recourse: Claimants on public projects, having no recourse to the property via an ML, rely on two main tools to secure payment:

- Filing a Stop Notice against the funds.

- Making a claim against the mandatory Payment Bond.

Both mechanisms provide necessary assurances that parties supplying labor or materials to public works will receive payment, thereby eliminating the element of favoritism, fraud, and corruption that the Public Contract Code is intended to prevent.

4. Interaction: Private Projects

On private construction projects, a claimant generally has the option to utilize three different methods for recourse:

- Filing a Mechanic’s Lien against the property.

- Serving a Stop Notice (often a bonded stop notice) against the construction funds, typically directed to the lender.

- Making a claim against the Payment Bond, if the owner required the general contractor to secure one (which is often done by owners to protect themselves from Mechanic’s Liens).

In this scenario, the stop notice and the bond claim provide alternative avenues to recoup debts in addition to the traditional Mechanic’s Lien. A claimant might prefer a bonded stop notice if they believe cutting off the flow of funds will lead to faster resolution and payment.